Should You Sell Your Policy?

If you no longer want or need your life insurance, you have a few options of what to do with it. Here we look at the four most common choices.

Four Common Options

Reduce Your Premiums

Keep your life insurance by paying lower premiums on your policy. Our initial analysis will show you whether you’re able to reduce your payments, and give you the choice to do so.

Cancel the Policy

Canceling the policy is the simplest option, but the payout is often so low that it doesn’t make sense to do this. However, many people are unaware that there are other options.

Sell Through a Broker

Brokers approach investors for you and get the best price for your policy that they can. However, they often lack the expertise to properly value your policy, and will take 15-30% of the final price.

Sell with Respiro Life

Our actuaries will analyze your policy to find the market value, then introduce you to the most suitable buyers based on who would be most suitable to buy it.

Case Studies from People Who Have Sold Their Policy

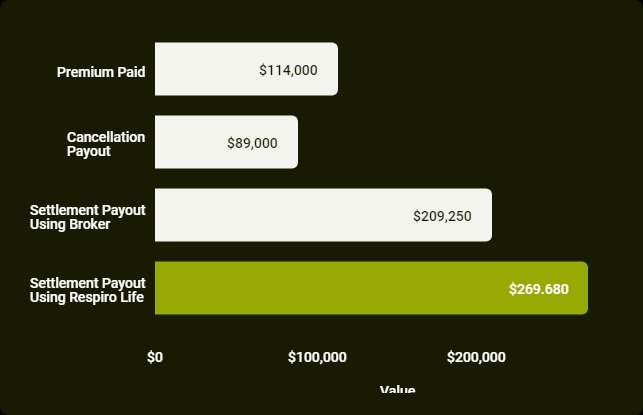

Matthew held his $1M life insurance policy for 20 years.

As an 80-year-old widower who lives alone with mild dementia, he and his two sons decided that it would be best for him to move into an assisted living facility. In order to fund this, they decide to sell Mathew’s policy to investors.

$114,000

Premiums Paid

$89,000

Cancelation Payout

$209,250

Settlement Payout Using Broker

$268,750

Settlement Payout Using Respiro Life

Barbara is an 72-year-old married grandmother who had a fall and broke her hip.

After surgery and physical therapy she’s moving well, but she decided to spend more time travelling the world and spending time with her family. Barbara chooses to sell her $500,000 policy and use some of the proceeds to take an extended Hawaiian vacation.

$18,700

Premiums Paid

$500

Cancelation Payout

$65,857

Settlement Payout Using Broker

$83,419

Settlement Payout Using Respiro Life

William is a 65-year-old grandfather who purchased a $250,000 life insurance policy when his children were young.

Diagnosed with terminal brain cancer 2 years ago, his ability to take care of himself has greatly diminished and he now needs 24-hour care. William and his family decide to sell the policy.

$24,000

Premiums Paid

$4,000

Cancelation Payout

$144,375

Settlement Payout Using Broker

$182,875

Settlement Payout Using Respiro Life

Get the Highest Payout by Working with Respiro Life

With more than 50 years experience working in the life insurance industry, analyzing 10,000s of policies worth tens of billions of dollars, we know how to value your policy to the penny.

At Respiro Life, we take that expertise and work for you. Our fee-based costs amount to less than 5% of the final sale price, which can add up to thousands in savings compared to a traditional brokerage.

With tens to hundreds of thousands of dollars at stake, our vast experience will give you the assurance that you’re getting the best outcome every step of the way.